2026 Market Outlook

While the broader luxury SUV market has softened in early 2026, vintage Defender valuations have decoupled from modern trends, showing a significant increase in demand for such bespoke vehicles.

A 1997 NAS Defender 90 with fewer than 1,325 miles on the clock hammered for $176,400 at RM Sotheby's Miami sale in February 2025[1]. That same truck carried a base sticker of $27,900 when it left Solihull nearly three decades ago[2]. That's more than a 530% return — on a vehicle originally designed to haul sheep and ford rivers. The numbers don't lie, but they also don't tell the whole story. Having overseen more than 150 ground-up Defender builds at Monarch, I've watched this market evolve from niche enthusiasm into serious collector territory. The question isn't whether Defenders are worth the investment. It's whether you understand what you're investing in — and how to protect that investment.

The Supply Equation: 2,016,933 and Falling

Every investment thesis starts with supply, and the Defender's supply story is irrefutable. Production of the classic Defender ended on January 29, 2016, when the last example — a Heritage Edition 90 Soft Top finished in Grasmere Green — rolled off the Solihull line at 9:22 in the morning[3]. That final truck bore the registration H166 HUE, a nod to the very first pre-production Land Rover, HUE 166[3]. In total, 2,016,933 Series Land Rovers and Defenders were produced across a continuous 68-year run at Solihull[3].

Two million sounds like a large number. It isn't — not when you consider that these vehicles served in military operations, agricultural work, expeditionary duty, and daily commuting across six continents. Attrition has been relentless. Rust, hard use, and scrapping have thinned the herd dramatically. At Monarch, we evaluate dozens of donor chassis each month, and the percentage that meet our structural standards has dropped every single year since we started tracking in 2018.

The American market faces an even tighter squeeze. The Defender was only officially sold in the United States from 1993 to 1997 under North American Specification (NAS), with roughly 2,000 to 2,800 units imported annually[4]. After the 1997 model year, U.S. regulations made continued sales infeasible, and official exports ceased[1]. That left a domestic pool of approximately 8,000 to 11,000 NAS Defenders — a finite number that can only shrink.

The Monarch Standard: When evaluating a Defender as a financial asset, the chassis tells the truth. We've seen cosmetically pristine trucks hiding catastrophic frame corrosion. Always demand photographic evidence of the underside before committing capital.

What the Auction Data Actually Shows

Let's set aside marketing copy and look at verified sale prices. The record for a NAS Defender 90 Hard Top reached $212,800 in November 2025[5]. For NAS Soft Top models, the top recorded sale hit $176,400 at RM Sotheby's Miami that same year, while the average transaction price across recent sales sits at $78,340[6].

Bring a Trailer, the largest online collector car auction platform, provides the broadest dataset. A well-documented 1997 NAS Defender 90 with 58,000 miles sold for $155,000 in January 2025[7]. Meanwhile, a 38,000-mile example brought $95,000 in June 2024, and a low-mile truck with clean provenance hammered at $106,000 in February 2024. The spread is enormous — and instructive. Condition, mileage, documentation, and originality create a valuation spectrum ranging from roughly $25,000 for running project trucks to well north of $150,000 for museum-quality survivors.

Remember those original base prices of $27,900[2]? Even a middle-of-the-road NAS Defender 90 trading at $78,340[6] represents nearly triple its original sticker. Clean, low-mileage examples have returned five to six times the original purchase price.

Hagerty, the premier insurer and valuation authority for collector vehicles, included the 1983–1997 Land Rover Defender on its 2022 Bull Market List[8] — their annual selection of vehicles most likely to appreciate. Hagerty's analysis noted that demand among American enthusiasts has been high enough to drive prices up even in Britain, as U.S. buyers scour the globe for inventory[9].

Why Defenders Defy Normal Depreciation

Most vehicles lose 60% of their value within five years. Classic Defenders move in the opposite direction. Understanding why is essential for any collector considering an allocation.

Finite Supply Meets Growing Demand

The math is stark. No new classic Defenders will ever be manufactured. Every year, more examples are lost to corrosion, accidents, and neglect. Simultaneously, the pool of qualified buyers expands as younger collectors — many of whom grew up seeing Defenders in Bond films and safari documentaries — enter the market with real purchasing power. The 25-year import rule in the United States has also opened a steady pipeline of European-market Defenders (particularly 300Tdi and Td5 models) to American collectors, broadening demand further.

The Heritage Premium

The Defender's story is singular. Conceived in 1948 by Spencer and Maurice Wilks — two brothers who sketched the original design in sand on a Welsh beach — the vehicle was intended for agricultural use[10]. What followed was 68 years of continuous production that touched every corner of the globe. From the British military to the Red Cross, from Antarctic expeditions to Royal estates, the Defender earned its reputation one hard mile at a time. That provenance — earned, not manufactured — adds a dimension of value that no modern SUV can replicate.

Mechanical Simplicity as a Feature

At Monarch, we strip Defenders down to bare chassis and rebuild them from the ground up. Having done this 150+ times, I can tell you that the Defender's engineering philosophy is one of its greatest assets from an investment standpoint. The ladder-frame chassis, live axles, and aluminum body panels create a vehicle that can be comprehensively restored — even improved — without losing its essential character. The introduction of the 300Tdi engine in 1994 brought a reliable 111 bhp and 195 lb-ft of torque paired with the R380 five-speed gearbox[11], replacing the older LT77 and providing a significantly more refined driving experience. These mechanical components are well-documented, widely available, and field-serviceable — qualities that underpin long-term collectability.

Builder's Note: The 1994 model year represents a significant inflection point for the Defender. The 300Tdi/R380 combination addressed many of the reliability concerns that plagued earlier drivetrains. For collectors prioritizing both investment potential and usability, post-1994 examples offer the strongest combination of both.

The Condition Multiplier: Where Fortunes Are Made or Lost

The single most important variable in Defender valuation isn't the model year or the body style — it's condition. And specifically, it's the condition of three things: the chassis, the bulkhead, and the documentation.

Chassis Integrity

The original mild-steel chassis is the Defender's Achilles heel. After decades of exposure — especially in climates where road salt is common — chassis corrosion can be terminal. At Monarch, every build starts with a comprehensive chassis inspection using calibrated ultrasonic thickness gauges. We're measuring steel thickness at 40+ points across the frame. A chassis that looks solid to the eye can be paper-thin in the outrigger mounts and spring hangers. This is where amateur buyers lose money: purchasing a truck with a fatally compromised chassis hidden under fresh underseal.

Our standard is hot-dip galvanization of the entire chassis — a process that provides decades of corrosion protection and is increasingly recognized by the market as a significant value-add. When we see unrestored trucks at auction, the ones sitting on galvanized frames consistently command 20-30% premiums over identical examples on original steel.

Bulkhead Condition

The bulkhead — the structural firewall between the engine bay and the cabin — is the second critical inspection point. On classic Defenders, this component is prone to corrosion along the lower edges and around the A-pillar footings. A corroded bulkhead isn't just a cosmetic issue; it's a structural one that compromises the vehicle's integrity. Replacement requires separating the body from the chassis — essentially a full rebuild. Trucks with documented bulkhead replacements or NOS (new old stock) bulkheads carry measurably higher valuations.

Documentation and Provenance

The third pillar of Defender valuation is the paper trail. Heritage Trust certificates, continuous service histories, matching VIN plates, and photographic documentation of prior condition all contribute to a truck's story — and its price. The BaT and RM Sotheby's results consistently demonstrate that extensively documented Defenders outperform comparable undocumented examples by significant margins.

The Restomod Premium: Where Modern Engineering Meets Heritage Value

Original, unmodified Defenders represent one investment thesis. Thoughtfully built restomods represent another — and increasingly, the more compelling one.

The logic is straightforward. A stock 1994 Defender 90 with the 300Tdi diesel produces 111 horsepower. It's charming and capable, but its highway manners, braking performance, and daily usability are distinctly agricultural. A professionally executed restomod — built from the ground up with a modern drivetrain, upgraded suspension, and contemporary safety features — transforms the same iconic platform into something you'll actually want to drive every day.

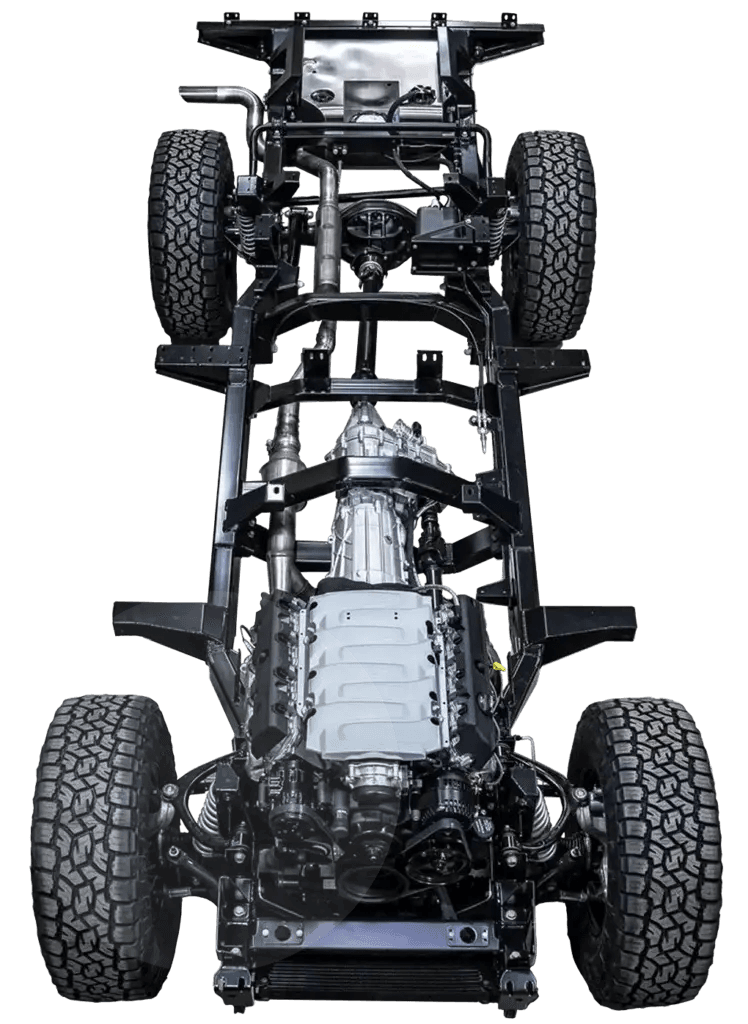

At Monarch, our builds pair the classic Defender body with GM's LS3 or LT1 V8 engines — delivering 430 to 460 horsepower through a modern 6-speed automatic transmission. The difference isn't subtle. But the value proposition goes beyond raw performance. A properly executed ground-up build addresses every weakness of the original: the chassis is galvanized, the wiring harness is new, the brakes are modern, the climate control works, and the interior is finished in hand-stitched Italian leather.

The market has noticed. Custom-built Defenders are regularly listed between $200,000 and $285,000[12], and they're finding buyers. These aren't speculative purchases — they're acquisition decisions by sophisticated collectors who understand that a properly built restomod offers the heritage and aesthetic of the classic Defender combined with the reliability and usability of a modern vehicle.

Monarch Perspective: Not all restomods are created equal. The market is increasingly discriminating between professional, documented, ground-up builds and backyard modifications bolted onto deteriorating platforms. If you're considering a restomod as an investment, demand complete build documentation — every photograph, every torque specification, every supplier invoice. At Monarch, our 13-stage build process generates a comprehensive dossier for exactly this reason.

What Could Go Wrong: Honest Risks Every Buyer Should Weigh

No honest investment analysis ignores downside risk. Here's what keeps me up at night:

Market Correction: The broader classic car market softened in 2023, with Hagerty's monthly market heat tracking falling to its lowest point in two years[13]. While Defenders proved more resilient than many segments, they are not immune to macroeconomic headwinds.

Regulatory Risk: As emissions regulations tighten globally, some jurisdictions may restrict the use of older vehicles. This is already happening in parts of Europe with low-emission zones.

Counterfeit and Misrepresented Trucks: The Defender's rising values have attracted bad actors. Cloned VINs, concealed accident damage, and fraudulent heritage certificates are genuine concerns. Hagerty has noted that demand has been strong enough to lure foreign-market Defenders into the U.S. via grey market channels, and buyers should verify any example's legitimacy carefully[2].

Restoration Cost Overruns: A Defender that looks like a bargain at $30,000 can easily consume $80,000 or more in restoration costs if the chassis, bulkhead, and running gear are compromised. The gap between purchase price and all-in cost catches more first-time buyers than any other factor.

The Verdict: An Asset Unlike Any Other

Are classic Land Rover Defenders worth the investment? The data supports a clear yes — with qualifications. Not every Defender is a good investment. A rusty, poorly documented, badly modified truck is a money pit, not an asset. But a well-selected, properly documented, and professionally maintained or rebuilt classic Defender occupies a rare position in the collector car market: a vehicle with genuine heritage, finite supply, growing global demand, and real-world usability.

The trucks that perform best as investments share common traits: verifiable provenance, structural integrity (especially in the chassis and bulkhead), low or well-documented mileage, and either pristine originality or professional-grade restoration. The NAS Defender 90 — particularly the 1997 final-year models — has established itself as the blue-chip variant for American collectors, with values that reflect both scarcity and desirability.

For those who view their Defender not merely as a garage queen but as a machine to be driven and enjoyed, a purpose-built restomod offers the strongest long-term value proposition: modern reliability wrapped in an irreplaceable silhouette, with comprehensive documentation to support future resale.

Commencing Your Commission

A Monarch Defender is more than a vehicle; it is a legacy. Our 13-stage ground-up build process is reserved for those who refuse to compromise. Start your commission today and consult with our master builders.